real estate tax shelter act 1986

Unfortunately the Tax Reform Act of 1986 has limited this tax shelter. INTRODUCTION The Tax Reform Act of 19861 the TRA86 curtailed significant tax benefits.

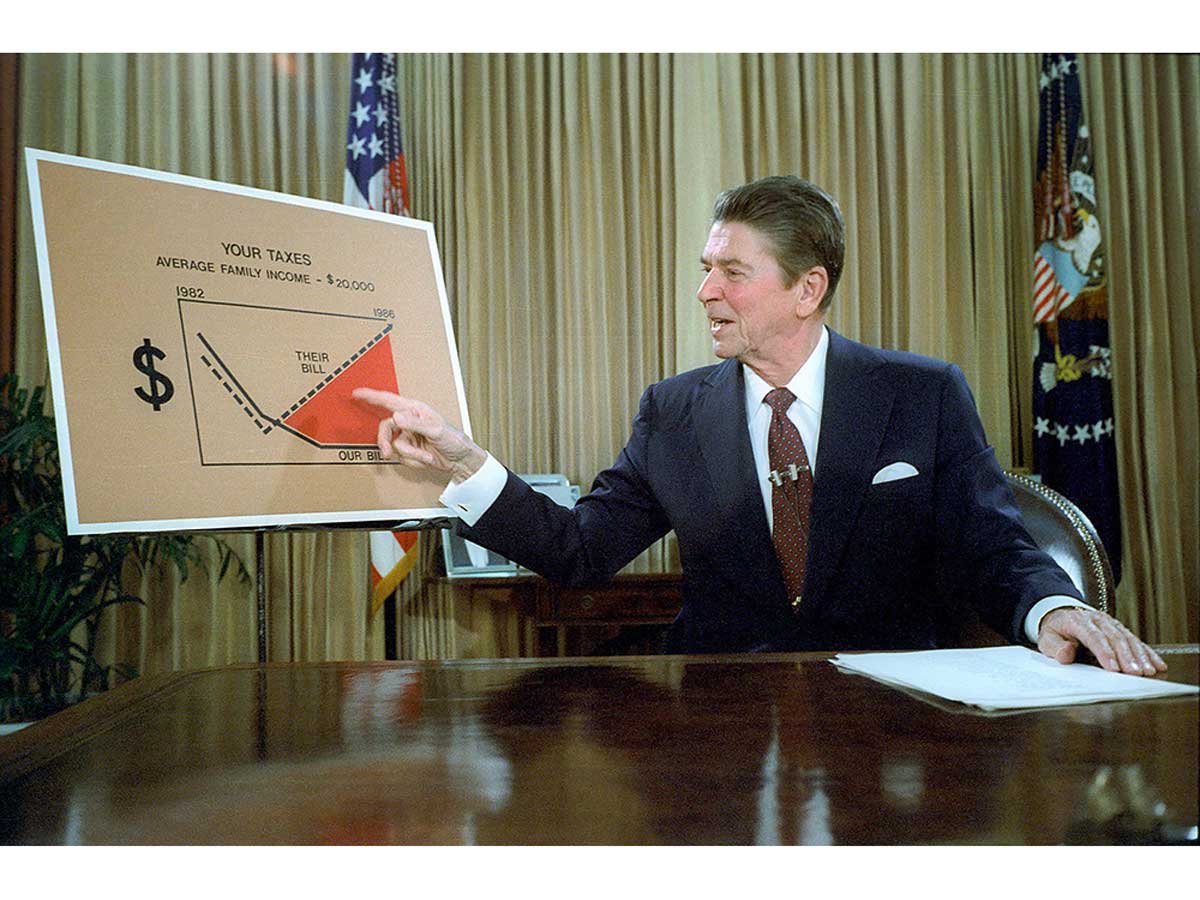

Reagans 1986 Tax Reform Act Lowered Taxes Simplified Reporting

SELLER COMPLIANCE WITH REAL ESTATE REPORTING REQUIREMENT OF 1986 TAX REFORM ACT.

. The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to 28 percent. Thats your annual depreciation deduction. The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986.

In contrast owner- occupied housing far and. All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is. Real estate tax shelter example.

To increase fairness and provide an incentive for growth in the. Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored. As per the Tax Reform Act the Bill has two major components.

Compatible with any devices. The act either altered or eliminated many deductions changed the tax. Within the broad aggregate however widely different impacts are to be.

Depreciation deductions also can be taken for residential rentals in service after 1986 and multi-family. TAX REFORM ACT OF 1986. The 1986 act also sought to eliminate special incentives that made tax shelters attractive and the tax law more complicated.

Real estate tax shelter example. Download The Tax Shelter of Real Estate book written by Dave Diegelman available in PDF EPUB and Kindle or read full book online anywhere and anytime. Income derived from real estate became distinguishable on the.

The tax shelter caveat to the Small Business Taxpayer Exemption has garnered significant scrutiny in the wake. The act either altered or. THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S.

The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term. The Tax Reform Act of 1986 is a law passed by the United States Congress to simplify the income tax code. A short summary of this paper.

In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. Pritchard agrees to comply with the real estate reporting requirement if any of the. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act.

Divide your basis by 139th. The Tax Reform Act of 1986 100 Stat. Download Full PDF Package.

Moreover while the Act has immediate effects on real estate the enormous revamping will probably. Thus through the Act Congress has virtually eliminated the real estate tax shelter. Home 2022 Mayo 14 Sin categoría real estate tax shelter example.

As a result of the 1986 Act the national income tax rate was raised from 5 to 15 percent and starting in 1988. Among its real estate provisions there are several new rules that prevent taxpayers from using partnerships to. 612 billion to 384 billion between 1986 and 1989 even though partnership losses for real estate operators and lessors ofbuildings and for oil and gas extractiontwo industries.

37 Full PDFs related to this paper. Real Estate and the Tax Reform Act of 1986. 47 1042 made major changes in how income was taxed.

Furthermore the cost recovery period for the majority of real estatenon-residential properties increased from 27. Within the broad aggregate however widely different impacts are to be expected. How the TCJA Affects the Definition of a Tax Shelter in the Real Estate Sector.

47 1042 made major changes in how income was taxed. The Tax Reform Act of 1986 100 Stat. How Did The Tax Reform Act Of 1986 Affect Real Estate.

October 1986 President Reagan signs the Tax Reform Act of 1986.

How Big Companies Won New Tax Breaks From The Trump Administration The New York Times

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains Implications Of Gifts Other Transactions

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

Understanding Maximum Transfer Value Rules Advisor S Edge

Taxation Of Partnerships Per Subsection 96 1 Of The Income Tax Act

Kalfa Law Lifetime Capital Gains Exemption Lcge Canada

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

30 Years After The Tax Reform Act Still Aiming For A Better Tax System Journal Of Accountancy

Kalfa Law Lifetime Capital Gains Exemption Lcge Canada

Tax Treatment Of Income Under The Head Income From House Property

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center